Good and Bad News about Virginia’s K-12 Education Budget

While we are celebrating that our K-12 education funding priorities are funded for the 2024-2025 fiscal year, we must remember that, rather than securing a steady funding base earmarked for K-12 education, some of the education priorities are funded with the budget surplus. What will happen to these education priorities next year when there is not a budget surplus?

This week we explain the good news, bad news, and ramifications of using surplus funds to meet our priorities.

The Good News

Finally, the months-long stalemate over the state budget ended on Monday, May 13, 2024, when the Governor signed the spending plan for 2024-2026. That plan includes $2 billion more in K-12 public education funding than was in the last budget and also recommends 3% pay raises for teachers and state employees each year. However, many localities may not have the funds to provide such raises because most of education funding comes from local, not state sources. After the Budget passed, House Appropriations Chairman Luke Torian (D-Prince William) shared, “We were able to address and fund all of our priorities.”

This good news was that a surging state revenue that exceeded an earlier forecast meant that this year’s spending plan had a financial buffer enabling budget lawmakers to fund K-12 education priorities while maintaining a balanced budget. The additional revenue allowed the priorities to be funded without reliance on an expansion of taxes on digital goods and services, originally planned to help meet the serious underfunding of K-12 education. But unlike a tax on digital goods and services, the surplus is a windfall that is not a stable revenue stream (see Bad News below).

One of the priorities in the General Assembly’s Conference budget was a major increase in at-risk add-on funding for High Poverty schools, extra money the state gives to school systems with a high proportion of economically disadvantaged students. Other priorities were additional funding for English Language Learners and an increase in teacher pay. This spending plan provides funds to increase by 3% the state’s portion of teacher pay raises over the next 2 years.

The Bad News

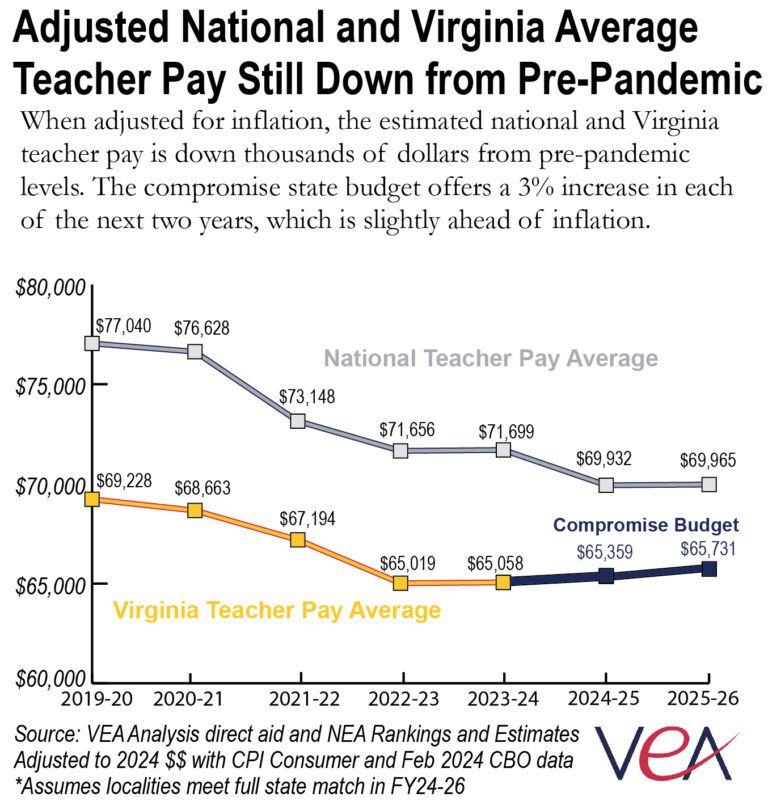

Teacher pay. Virginia’s teacher pay rate is well below the national average and this budget resolution does not fix that gap. The General Assembly passed a bill with the goal of getting Virginia teachers' pay-rate to the national average by 2026, but the Governor has not yet signed the bill. (He has until May 17th to act on it.) Instead of providing a pay raise that could help to realize that goal, the compromise budget increases by 3% the Commonwealth’s portion of pay raises. This is far from an amount that will help close the gap between school employee salaries and that of the national average. In fact, it barely keeps up with inflation. Because Virginia has fallen even further behind the national teacher pay average, the Commonwealth will need to approve a pay raise of 14% the next budget cycle to meet the goal of national teacher pay average by the 2027-28 school year.

Apparently, the Governor still has the misconception that Virginia already has closed the gap in teacher pay relative to the national average, which is far from the truth. This erroneous belief is based on a flawed analysis by his administration that claimed there were mistakes in the Joint Legislative Audit and Review Commission’s (JLARC) report on the teacher pipeline. However, most recognize that it was the Governor’s analysis that was flawed and recently the Virginia Education Association elaborated on the basis of the administration’s error.

The graph above shows that when adjusted for inflation, Virginia teacher pay average is well below that of the National Average pay for teachers. The compromise state budget recommends an increase of 3% each year for the next 2 years. However, most of the burden of providing those raises will fall on local school districts.

Instead of approving the bill that would provide the raise needed to meet the goal by 2026, Governor Youngkin decided we should “study” the issue rather than act on revising it. As a result, school districts are still getting funded using outdated tax policies and formulas, and school districts continue to be underfunded.

Long term funding stability. Although K-12 education priorities were partially met this funding cycle, there is concern about the long-term fiscal stability of education funding. The revenue source used to meet current needs is not stable because it is based on a temporary revenue surplus.

Originally, a change in the digital sales tax was identified as the revenue source earmarked for continued and direct K-12 education support. This was especially important in providing funding for high poverty school districts. That tax change was not approved but instead the shortfall for this priority was covered with this year’s budget surplus. What is not clear is how funding for high poverty schools or any other education priority will be funded in subsequent years when we may not have a budget surplus. There is a critical need for legislators and the Governor to identify a stable revenue source to fund education priorities.

Governor Youngkin vetoes localities’ ability to raise funds. Governor Youngkin vetoed the bill that would have allowed localities to hold a referendum on a local sales tax to support schools. By vetoing this bill the Governor has prevented localities from accessing a stable funding source for their schools.

The impact of his veto on HB 805 is potentially serious. Public school districts in Virginia receive only a fraction of their operating budget from the state. For example, Fairfax County Public Schools receive only 19% of their funding from the state. An immediate ramification of this veto is that school districts may have to reduce planned teacher salary increases. For example, Fairfax County Public Schools may have to reduce teacher salary raises from 6% to 3%.

Other than the 1.3% contribution from the federal government, the balance of the funding comes from local sources including revenue from property and sales taxes. A recent albeit unpopular increase in property taxes for Fairfax was intended, in part, to better fund the schools. Youngkin’s veto of HB 805 has eliminated the ability of all localities to use a referendum to potentially increase financial support for their public schools.

JLARC recommendations were barely addressed. With the $371m for high poverty schools and the $71m to better support English Language Learners, Virginia has met only 4% of the $10 billion worth of critical recommendations made in the JLARC Report. And this is in a year when we have a budget surplus! What will happen to public education when the budget tightens again?

"By only meeting 4% of the JLARC funding recommendations and falling further behind the national teacher pay average in this budget, lawmakers must find sustainable ways to increase revenue to meet our critical K-12 funding needs and fulfill their promises.... Retreating from RGGI and abandoning modernization of our sales tax in this budget means lawmakers must be even bolder in the coming years to propose significant tax restructuring to address the serious challenges facing our students and staffing shortages across our public schools.” - Dr. James Fedderman, President of Virginia Education Association

コメント